1 The UK Benefits system: background

Introduction

The UK Benefits System is a combination of assistance and insurance programme administered by central and local authorities, that providing practical help and financial support for those facing social risks including unemployment, ill health, disability, bereavement and old age 4. It provides eligible individuals with additional income when their earnings are low in the case they are unemployed or looking for work, if they are bringing up children, are retired, care for someone, are ill or have a disability

The system includes a variety of social security and welfare benefits 5, which are mostly common across Wales, England and Scotland, with a slight variation in some of them for claimants residing in N. Ireland (see Table 1. Some types of social security and welfare benefits per country for an overview).

Table 1. Some types of social security and welfare benefits per country

| Benefit | England | Wales | Scotland | N. Ireland | |

|---|---|---|---|---|---|

| Free School meals | ✔ | ✔ | |||

| Free School Lunches | ✔ | ||||

| ‘Food in Schools’ policy | ✔ | ||||

| Care to Learn | ✔ | ||||

| Carer’s Credit | ✔ | ✔ | ✔ | ✔ | |

| Child Trust Fund/Junior ISAs | ✔ | ✔ | ✔ | ✔ | |

| Childcare grant | ✔ | ||||

| Injury while serving in the armed forces | ✔ | ✔ | ✔ | ✔ | |

| Guardian’s Allowance | ✔ | ✔ | ✔ | ✔ | |

| Healthy Start | ✔ | ✔ | ✔ | ✔ | |

| Childcare Help | ✔ | ✔ | ✔ | ✔ | |

| Maternity Allowance | ✔ | ✔ | ✔ | ✔ | |

| Access to work | ✔ | ✔ | ✔ | * | |

| Disability Living Allowance | ✔ | ✔ | ✔ | ✔ | |

| Personal Independence Payment (PIP) | ✔ | ✔ | ✔ | ✔ | |

| Attendance allowance | ✔ | ✔ | ✔ | ✔ | * |

| Blind Person’s Allowance | ✔ | ✔ | ✔ | ✔ | |

| Carer’s Allowance | ✔ | ✔ | ✔ | (✔) | |

| Carer’s Credit | ✔ | ✔ | ✔ | (✔) | |

| Disability premiums | ✔ | ✔ | ✔ | ✔ | |

| Disabled Students’ allowances (DSAs) | ✔ | ✔ | ✔ | ✔ | |

| Employment and Support Allowance (ESA) | ✔ | ✔ | ✔ | ✔ | * |

| Incapacity benefit (superseded by ESA) | ✔ | ✔ | ✔ | ✔ | * |

| Income Support | ✔ | ✔ | ✔ | ✔ | |

| Child Benefit | ✔ | ✔ | ✔ | ✔ | |

| Heating and housing benefits | ✔ | ✔ | ✔ | ✔ | |

| Jobseeker Allowance | ✔ | ✔ | ✔ | ✔ | |

| Universal Credit | ✔ | ✔ | ✔ | ✔ 6 |

Benefits are administered by several different organisations, depending on the country the claimant resides in. For those residing in England, Scotland and Wales, the Department for Work and Pensions (DWP) is responsible for most benefits related to unemployment. JobCentres Plus, the Disability and Carers Service and the Child Maintenance Service administer benefits on DWP’s behalf and are the main point of contact for potentially eligible benefit applicants.

For claimants residing in Northern Ireland, most benefits are administered by the Department for Communities and the Department for the Economy. These were previously administered by the Department for Employment and Learning.

In England, Wales and Scotland, local authorities manage housing benefit, and council tax reduction schemes, whereas HM Revenue and Customs (HMRC) administers child benefit, guardian’s allowance and the tax credit system. (Taylor-Gooby & Taylor, 2015).

This is a very brief overview, however. The welfare landscape is everchanging - the reforms introduced since 2010 have been wide-ranging (see (Taylor-Gooby & Taylor, 2015) for an overview of recent changes). The introduction of the Universal Credit Benefit is expected to change the data landscape drastically as well. Scotland is expected to acquire legislative control over 11 benefits after June 2017 and executive responsibility of all devolved benefits by April 2020 7. In addition to potentially introducing another variation in the types of data collected and a different set of administration and decision policies, the devolution of the powers will mean that more organisations will be involved as data controllers for data generated after that time.

In what follows we will attempt to summarise the process of decision making with regards to benefits, but in doing so, there will be a lot of nuanced details we have not included. For a full overview of the benefits system in the UK over time, see among others (Aldridge, Kenway, MacInnes, & Parekh, 1981; James, 2004; Jordan, 2012; Levell, May, O’Dea, & Phillips, 2009; MacLeavy, 2011; Murie, 1997; Raco, 2009; Robinson, 1998; Tarr & Finn, 2012; Walker & Wiseman, 2003). The related gov.uk, gov.scot, gov.wales and nidirect.gov.uk pages are also very helpful and frequently updated and a good source of information as to the most up to date version of these processes. For more information on the impact of Universal Credit on 'passported' benefits, see the Social Security Advisory Committee and Department for Work and Pensions’ report .

1.1 Decisions on benefits

Decisions on most social security benefit claims are made by DWP/DfC staff following a set of rules. Doubtful claims are decided by DWP/DfC staff called decision makers, who make decisions on behalf of the Secretary of State 8.

Decisions about Working Tax Credit, Child Tax Credit, Child Benefit and Guardian’s Allowance are made by HMRC officers.

Decisions about Housing Benefit and Council Tax Support are made by Local Authorities. Decisions about Statutory Sick Pay, Statutory Maternity Pay, Statutory Paternity Pay and Statutory Adoption Pay are made by employers.

Decisions about Armed Forces and Veterans benefits are made via the War Pensions and Armed Forces Compensation tribunal.

1.1.1 Appealing a decision

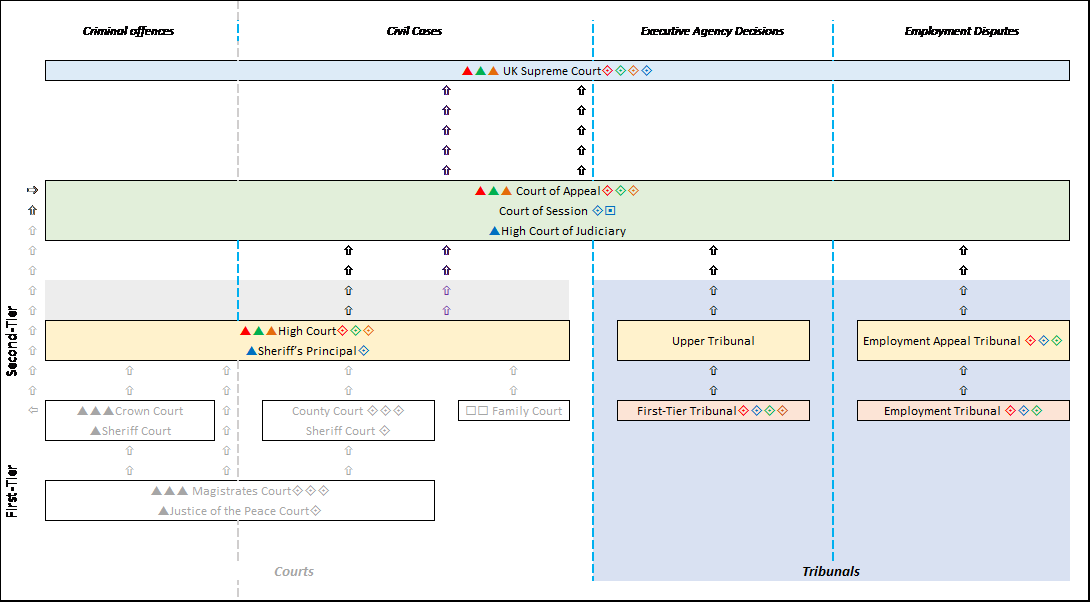

Decisions about most benefits can be appealed via the UK Tribunals System as Executive Agency Decisions (see Appendix A: The UK Courts and Tribunals system). Executive Agency Decisions include cases that start as appeals to decisions, usually by governmental organisations and agencies, for example appealing a decision of a government department on the benefit, tax or immigration status allocated. Decisions made by employers can be appealed at the Employment Appeal Tribunal.

The Tribunals, Courts and Enforcement Act came into force on 3 November 2008, creating a new two-tier Tribunal system: a First–tier Tribunal and an Upper Tribunal, both of which are split into Chambers. Each Chamber comprises similar jurisdictions and brings together similar types of experts to hear appeals. The first tier of appeal in these cases for all countries is the First-Tier Tribunal which considers the appeal in the first instance. If not resolved, cases can be further considered by the Upper-Tier Tribunal (England, Wales, Scotland, N. Ireland) and then the Court of Appeal (England, Wales, N. Ireland) or the Court of Session (Scotland).

Figure 1 highlights the parts of the system of potential interest that we will further consider in this report, which are highlighted in colour:

Figure 1. The UK Courts and Tribunals System (areas of relevance to administrative justice)

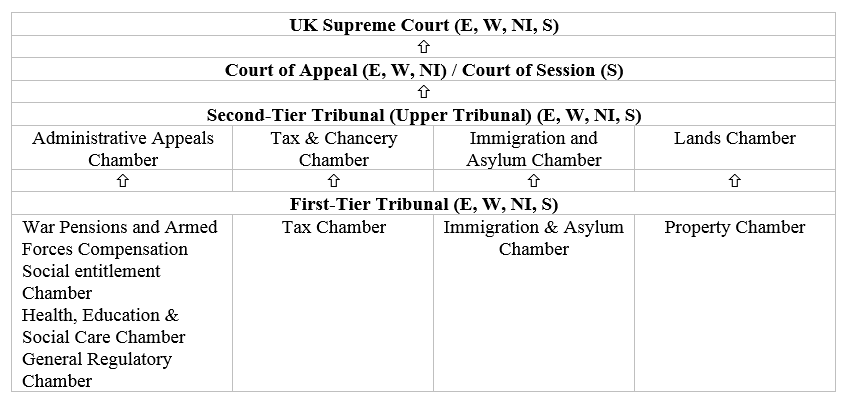

The highest possible court that can consider these decisions is the UK Supreme Court, which hears cases from all four countries. Table 2 summarises the system for these decisions:

Table 2. Overview of the tribunals system for Executive Agency Decisions

The kind of First-Tier Tribunal and Second-Tier Division that a decision can be appealed to varies, but will overall be considered by one of the following divisions (Table 3). The first two are usually relevant to social security and welfare benefits:

Table 3. First and Second Tier Tribunal Appeals

| First-Tier Tribunal | Second-Tier Tribunal (Upper Tribunal) | |

|---|---|---|

| War Pensions and Armed Forces Compensation Social entitlement Chamber Health, Education & Social Care Chamber General Regulatory Chamber |

→ | Administrative Appeals Chamber |

| Tax Chamber | → | Tax & Chancery Chamber |

| Immigration & Asylum Chamber | → | Immigration and Asylum Chamber |

| Property Chamber | → | Lands Chamber |

Below is a list of some of the individual organisations’ requirements/paths when appealing their administrative decisions:

(a) DfC/DWP& HMRC decisions: For DfC/DWP and HMRC benefits the claimants must first ask for the decision to be reconsidered (called mandatory reconsideration 9 and only then can they appeal.

In N. Ireland, the way a claimant can dispute a decision on benefits administered by the DfC changed on 23 May 2016 (a bit later compared to the rest of the countries, which transitioned in 2013). Claimants will now need to ask the office that made the decision to formally reconsider, before they can make an appeal – this is known as Mandatory Reconsideration 10.

Following a Mandatory Reconsideration, claimants may appeal the decision, by sending their appeal directly to the Appeals Service (TAS) rather than the Social Security Office or the Jobs and Benefits Office that made the decision. This process is referred to as Direct Lodgement.

Before May 2016, decisions can be appealed via the Appeals Service, who will send the appeal to an Independent Tribunal 11.

(b) Local Authority Decisions: Local authority benefits can be reviewed by the local authority and/or appealed at the related First-Tier Tribunal.

(c) Employer benefit decisions: Employer benefit disputes are dealt with by HMRC and can be further appealed at an Employment Tribunal.

(d) War Pensions and Armed Forces Compensation Decisions: In England, Scotland and Wales, claimants can appeal to the first-tier Tribunal (War Pensions and Armed Forces Compensation Chamber) if they disagree with a decision about their war pension, benefits or compensation. Appeals should be applied for within 1 year of receiving the decision letter. The tribunal will decide whether the injury was caused or made worse by serving in the armed forces. If it was, it can then make decisions about:

- Claimant’s entitlement to a pension or compensation

- how much pension you get

- your entitlement to extra allowances, e.g. for mobility needs

- pension start dates

- withheld pensions

The tribunal deals with appeals for the 2 pension schemes currently running, which are:

- the War Pensions Scheme - for injuries caused or made worse by service before 6 April 2005

- the Armed Forces Compensation Scheme - for injuries caused by service from 6 April 2005 onwards

To appeal, claimants write a letter to Veterans UK 12 requesting that they reconsider their decision, providing any further information and explanations. Veterans UK consider the request and respond with their decision. If the claimant thinks this does not address their concerns, they can escalate their request to the Upper Tribunal (Administrative Appeals Chamber) across the UK. Forms and further documentation is available via the Veterans UK website.

In N. Ireland, claimants can appeal to the Pensions Appeal Tribunal, which has been hearing appeals from ex-servicemen or women who have had their claims for a War Pension rejected by the Secretary of State for Defence since the War Pensions Act 1919. Its jurisdiction covers N. Ireland only and is independent from Veterans UK.

Complaints

(a) DWP: If a claimant is not satisfied with the outcome of the appeal of one of the DWP agencies (in particular: JobCentre Plus, the Disability and Carers’ Service, the Pension Service, Debt Management, Financial Assistance Scheme, Child Support Agency and Independent Living Fund), they can lodge a complaint through the office they have been dealing with, this is reviewed by a Case Manager. If they remain unhappy, they can escalate their complaint to the Independent Case Examiner.

You need to have received a letter from the DWP agency mentioning that this is their ‘final response’ and need to submit the complaint within 6 months of getting the final response. In any case, any legal costs will need to be paid by the claimant.

If this complaint is not upheld the claimant can complain to the Parliamentary and Health Service Ombudsman.

(b) Department for Communities (NI): There are two separate approaches for handling complaints within the DfC:

The first is for business areas where the complainant is unhappy with a decision or service provided by the Department. These complaints do not normally involve services which are provided to individual customers. Initially, complaints can be addressed to the department directly and if not satisfied, complainants can ask for re-examination by the Director and escalate this further to the Northern Ireland Public Services Ombudsman.

The second approach is for business areas where the complainant is unhappy with a decision or service provided by the Department. These complaints involve services which are provided to individual customers. Initially, complainants need to write to the office that has made the decision directly. If the complaint is still unresolved, the complainant can ask for the complaint to be re-examined and if needed further escalate it to the Case Examiner.

(c) Local Authority Decisions: Complaints are usually directed to the office and then the local authority that made the decision about the benefits in the first instance. Each local Authority usually publishes this on their webpages with additional information on the process and the forms that need to be filled in. If complaint is still unresolved, the case can be submitted to an Ombudsman.

(d) Employer benefit decisions: In the first instance, complaints are dealt with by the employer, following their complaints procedure. This is not always published online. If the complaint remains unresolved, the case can be escalated to an Ombudsman.

(e) War Pensions and Armed Forces Compensation Decisions: Complaints about benefits and sanctions, are usually made by contacting the Veteran’s Chain of Command or the HIVEs in the first instance. If unresolved, a complaint can be escalated to the Service Personnel and Veterans Agency (SPVA)30 or if it remains unresolved to an Ombudsman.

Benefits explored in this report

To demonstrate the potential of using administrative data for empirical research in the field of administrative Justice, we will be presenting a detailed overview of two social security benefits: the Employment Allowance Support Benefit and the Personal Independent Payment Benefit and the related data sources around decisions, appeals and complaints.

For each benefit, we provide some information about the benefit and how it is being administered. We also present an overview of the main decision points and opportunities for appeal, as per the current guidance available in the gov.uk pages for this benefit. For each of these steps in the process, we provide an overview of the data that is recorded, and where published links to the source available. In addition to the decision, sanction, appeal or complaint data, we also provide information on data sources that could be used to create a baseline for analysis.

Table 4, presents an overview of the data available for the different types of baseline data, appeals and tribunals data and complaints data with a brief comment of their data and metadata quality.

Table 4. Overview of Data Availability for Benefits

| Benefit | baseline data (decisions) | baseline data (sanctions) | appeals and tribunals data | complaints data |

|---|---|---|---|---|

| ESA | available, good quality | available, ok quality | available, good quality | available, ok quality |

| PIP | available, good quality | not applicable for this benefit | available, good quality | data not available |

4. Prof. Griánne McKeever, pc. ↩

5. By benefits here, we mean mainly social security benefits (i.e. mainly benefits administered by the Department for Work and Pensions in England, Scotland and Wales, and the Department for Communities in N. Ireland) although some discussion and resources on other types of welfare benefits are included (such as those administered by Local Authorities and HMRC – for example tax credits). ↩

6. Universal Credit will not apply in N. Ireland until Sept 2017. ↩

7. See this Guardian article for more. ↩

8. Delays in decision making: There are target times for making decisions on benefit claims but these are not always met. If the claimants have claimed a benefit and not received a decision, they may want to contact the DWP, HMRC or local authority to find out the reason for the delay. If they say they have not received the claim, send them a copy or fill out another form explaining when and how the first form was sent. Ask for the claim to be backdated so that they do not lose out on benefit the claimants were entitled to. ↩

If there is a long delay in making a decision on the claim they can:

- make a complaint about the delay

- request advance or interim payments

- see if there is another benefit they can claim

- contact their local authority to see if the they can receive help from the local welfare provision scheme, or in Wales the national Discretionary Assistance Fund

9. Mandatory reconsiderations: For DWP benefits, if the claimants disagree with a decision on any ground, they can ask for a revision within one month of the date of the original decision. For HMRC benefits, the claimants must ask for the revision within 30 days of the date of the decision. The claimants have to take this step, known as a ‘mandatory reconsideration’, before they can appeal. It is important to act within the time limits or they could lose arrears of benefit or find that they cannot challenge the decision at all. A mandatory reconsideration can be requested over the telephone, but the claimants should confirm their request in writing. ↩

Claimants should explain why they think the decision is wrong and send any extra evidence they may have. If this cannot be send straight away they can be given one month to send extra evidence and this time limit can be extended at the decision maker’s discretion. If the decision letter does not include reasons for the decision that has been made, the claimants can ask for a ‘written statement of reasons’. The claimants must do this within one month of the date of the decision.

If the claimants ask for the written statement and it is provided within that time, the dispute period is extended by 14 days; if it is provided afterwards, the dispute period is extended to 14 days from the date it is provided. Unfortunately, the claimants cannot always tell from the decision letter whether reasons are included.

The decision maker will send the claimants a new decision detailing whether they have changed their original decision once they have all the information they need. They should send the claimants two copies of a Mandatory Reconsideration notice, which the claimants need if the claimants wish to appeal further.

10. See the full procedure of Appealing against a benefits decision on nidirect.gov.uk. ↩

11. See Appealing against a benefits decision on nidirect.gov.uk. for up-to-date information on this. ↩

12. Veterans UK was previously known as the Service Personnel and Veterans Agency (SPVA). ↩